Key takeaways

- Consistency and discipline are essential for improving your credit score quickly and effectively.

- Utilize tools like secured credit cards and rent reporting services to establish a positive payment history.

- Always pay your bills on time, maintain a low credit utilization ratio, and open new accounts sparingly.

Your credit score affects so much of your financial life. The terms of your mortgage, financing your car, or even whether you’re approved for the apartment you want. When you have less than ideal credit, it can be difficult to get good interest rates and terms, so you end up paying more than you should. It’s not fair.

While it can be tough to improve your credit rating, it’s not impossible. There are actually ways to boost your score fast with a little effort and discipline. And the good news is, the lower your credit score, the more dramatic the results.

Here’s how you can turn less than ideal credit into good credit in as little as 60 days and keep it that way.

What determines your credit score

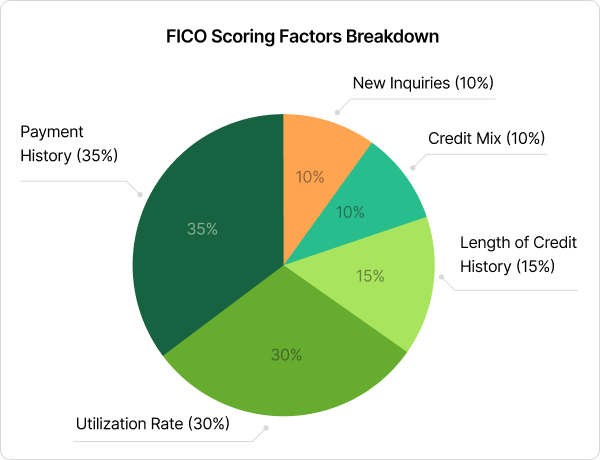

Understanding what determines your credit score is the first step in effectively managing and improving it. There are plenty of floating around, but don’t believe everything you hear. How your score is calculated is actually very simple. Credit scores are based on five factors:

- Payment history (35%) is the most significant factor. Timely payments on your credit accounts positively impact your score. Late payments, defaults, and bankruptcies negatively affect it.

- Credit utilization (30%) is the ratio of your current credit card balances to your credit limits. Keeping this ratio below 30% is ideal for a healthy score.

- Length of credit history (15%) is the average age of all your accounts. The longer your credit history, the better.

- Credit mix (10%) is the different types of accounts you have. Lenders prefer a diverse mix of installment (loans) and revolving (credit cards) credit.

- New credit (10%) indicates higher risk. Opening a new account includes a hard credit inquiry, which temporarily lowers your score.

By understanding these factors, you can take strategic actions to enhance your credit score over time. Generally, it comes down to paying on time and not relying on credit.

Steps to improve your low credit score in 60 days

It doesn’t take long to see improvement in your credit score. One or two billing cycles should do the trick as long as you follow the basic rules. Let’s go over and a few tips you can employ.

1. Get a secured credit card

One credit-building tool to start with is a secured credit card. Secured cards function like regular credit cards but require a cash deposit. The deposit acts as collateral for the issuer. If you forget to pay your bill, they keep the money. As a result, secured credit cards tend to be very may be more accessible based on eligibility criteria.

Apply for the starter card and put down your deposit. The deposit typically sets your credit limit or how much you can spend. Some issuers have flexible deposit requirements. You may be able to use money in a linked bank account or increase your limit without adding to your security deposit.

The key with a secured card is to pay your bill on time every month and to keep your spending well below your limit. Also, make sure that you’re issuer reports to all three major credit bureaus – Experian, Equifax, and TransUnion. Reporting to all three will help improve your score the most.

2. Don’t miss payments

The is to pay your bills on time every month. Payment history is the most important factor in calculating your score. Even one late payment can set you back.

The nice thing about credit cards is that you have extra time to pay. Most credit cards have a grace period during which you are not charged interest. The grace period is usually 15-21 days and occurs between the statement closing date and the due date. Pay your bill in full during that time. You will save money on interest and improve your credit.

If you are late, the credit card issuer will charge you a late fee and may increase your APR. One positive is that they usually don’t report late payments to the credit bureaus until you are over 30 days past due. Pay your bill before you hit 30 days late to save your score.

Set up automatic payments or put reminders in your phone so that you’re never late. Most credit card companies will remind you about due dates as they want their money, too.

Looking for a quick credit boost?

3. Pay bills bi-monthly

Payment history is very important, but so is your credit utilization. Your credit utilization is how much you’ve spent compared to your limit. It’s calculated both by your individual cards and cumulatively. If you keep your credit utilization ratio below 30% on your individual cards, you don’t have to worry about what it is cumulatively.

One trick is to pay your bill twice a month. Credit card issuers generally report your utilization at the end of the billing cycle. Pay down your balance before then, and they’ll report a lower utilization rate.

Put a reminder in your phone to look at your balance mid-billing cycle. Then, pay it down so you can continue spending the rest of the month. If you don’t want to think about it, you can set up autopay. Calculate how much you spend on credit per month. Divide that number in half and set up auto-pay for that amount mid-billing cycle.

The goal is for your utilization to be under 30% when reported. If you can, bring your utilization under 10%. Being in the single digits will help your score the most.

4. Keep new credit inquiries to a minimum

When you apply for credit, whether it’s a loan or a credit card, the financial institution will do a hard inquiry on your credit report. A hard inquiry will lower your score temporarily by five to ten points. One isn’t a problem. Your score will bounce back quickly. Multiple hard inquiries in a short period of time will damage your credit.

To avoid this, do your research and try to check eligibility without affecting your score. A lot of financial institutions offer prequalification tools for both credit cards and loans. You can check eligibility without affecting your score without hurting your score and see what terms you’re offered. Then, formally apply for the card or loan that suits you the best.

Being prequalified does not guarantee approval, but it does let you know if you meet the basic criteria. Applying for a credit card you’re prequalified for lessens the chances of rejection and unnecessary credit score damage.

If you are denied a credit card or loan, wait at least six months before applying again. The waiting period lets your score recover and shows lenders that you’re not desperate for credit.

5. Get credit for rent and utility payments

Your on-time rent and utility payments can instantly boost your credit score, but you need to take the right steps to set it up. Typically, only your credit card and loan payments are reported to the credit bureaus. This is because they involve borrowing. A credit reporting service ensures that other bills are added to your credit report. You then get credit for bills you’re already paying on time.

Find a company that reports rent, utility payments, subscriptions, and phone bills. The ideal company will report to all three credit bureaus. You never know where a lender will pull your credit score from, so getting the boost for all three is best.

Adding these accounts to your payment history shows lenders that you are reliable and financially responsible.

Do you pay rent on time?

6. Ask for a credit limit increase

A higher credit limit makes it easier to keep your credit utilization ratio below 30%. If you have a history of on-time payments or have received a raise at work, ask your issuer for a limit increase. They may be happy to oblige. Be prepared to explain your reasons for needing a higher limit, such as your commitment to improving your credit score and your responsible credit habits.

Some credit card providers conduct a hard inquiry before approving an increase. If you’re worried about how a hard credit check could affect your score, ask your provider about their policies.

Once you receive your limit increase, keep spending the same. Falling for the temptation to spend more won’t do anything to help your score.

7. Check for any fraudulent activity

Fraud could be the culprit dragging your score down. Credit card fraud is common, though the instances are decreasing. It happens when someone applies for a new credit card using stolen information or when someone uses an existing account without the cardholder’s permission.

What you can do is review your statements every month for fraudulent charges. Then check your credit reports from each of the three bureaus. You can get them for free once a year via annualcreditreport.com. Look for accounts you didn’t open, an incorrect name, or a wrong address. Dispute any inaccurate negative marks you see. Getting errors off your report can give an immediate boost to your score.

To prevent fraud and preserve your score, set up alerts through your credit card issuer. The alerts can be for purchases over a certain amount or a type of transaction. Being on top of how your card is used will help you spot fraud when it happens.

What makes a good credit score

A good credit score is considered to be 670 or higher on the FICO score range or 661 and higher on the VantageScore model. Both models range from 300 to 850. Scores in the good range indicate to lenders that you are a reliable borrower who is likely to repay loans on time. This, in turn, increases your chances of securing loans and credit with favorable terms.

You can still get credit cards and , but the interest rates will be higher than if your score were good. In other words, while you can still borrow with less than ideal credit, improving your score will save you money.

Frequently asked questions

1. How to get a 720 credit score in 6 months?

To bring your score up to 720 in 6 months, you must pay every bill on time and in full and keep your credit utilization under 10%. Staying under 30% will help your credit score, but being in the single digits will have a greater impact. Report other monthly bills you pay on time – rent, phone, and utilities. You can also take out a credit-builder loan to further boost your score. Again, it is extremely important to pay on time every month.

2. How to boost your credit score in 30 days?

To boost your score in 30 days, you need to make that billing cycle count. Pay down your balance before it’s reported so your utilization is under 10%. Pay your bill on time. Check your credit report and dispute any errors you find with the issuing bureau. Do not apply for new credit cards or loans in those 30 days.

3. How long does it take to improve a credit score after debt settlement?

It typically takes 12 to 24 months to see significant improvement in your credit score after debt settlement. Debt settlement will remain on your credit report for up to seven years and can drag your score down by over 100 points. Remaining current on all accounts, paying on time, and reducing your utilization to under 10% can help your score.

4. How long does it take to raise your credit score 20 points?

It’s difficult to pinpoint exactly how long it will take to raise your credit score by 20 points. The amount of time it takes depends on your individual credit history. Consistently pay your bills on time, maintain a low utilization, and don’t apply for new accounts. Your score could increase within 30 to 45 days.

5. How to improve credit score after bankruptcies?

Rebuilding credit after bankruptcy is tough. Credit cards and are difficult to come by. Your best bet is opening a secured credit card and taking out a credit builder loan. Keep your usage under 10% of your limit and pay all your bills on time. Engage a rent reporting service so that you can get credit for other timely payments. Gradually, your score will improve.

Bottom line

Improving your credit score takes time, patience, and discipline. While significant progress can be made in as little as 60 days, achieving an excellent credit score will take longer.

It’s essential to stay committed. Consistently using credit responsibly is the only way to get a good score. Regularly monitor your credit score, pay your bills on time, keep your credit utilization low, and open new accounts sparingly. By adhering to these practices, you’ll gradually build credit.

Over time, your hard work will pay off. You will be able to secure rewards credit cards with higher credit limits and loans with favorable terms. Remember, a good credit score is a valuable asset that can lead to a brighter financial future and greater financial stability. Stay focused, be patient, and continue to make smart financial decisions.