If you have limited or poor credit it can be hard to get a credit card. Most card issuers say you need good credit – 670 or above – to get a card. The problem is, to build that good credit you need credit accounts that they won’t give you. It’s frustrating, we know.

Applying for a credit card can be nerve-wracking. So we’ve put together steps to help you apply and get approved.

That’s why we have a solution for you. Cards with no credit checks. They may be less common, but there are enough out there that you’re sure to find one that fits your needs.

To help you get started, here are our favorite no credit check cards.

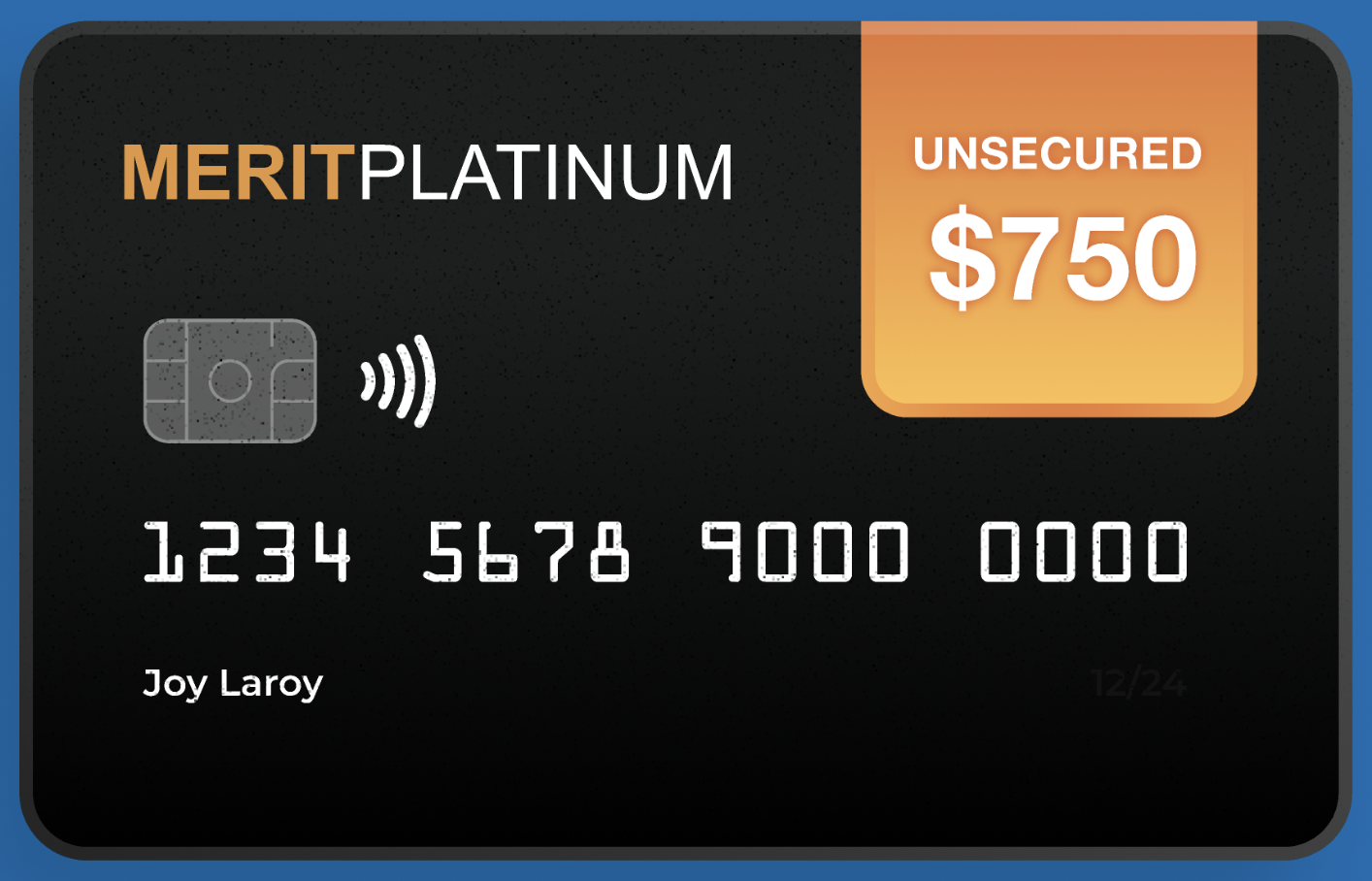

1. Merit Platinum Card:

Get a $750 Credit Line Today – Guaranteed Approval!

- No Credit Check

- Get Prescription Discounts

- Easy Application

2. Current Build Card:

Build Credit with Every Swipe!

- Earn Cash Back with Each Purchase

- Get Credit for Banking You Do Every Day

- No Credit Checks of Minimum Security Deposit

3. Accepted Platinum:

Enjoy a $1,000 Credit Line. Fast Approval Guaranteed!

- No Application Denied for Poor Credit

- Get $25 in Rewards Every Month

- No Credit Check

4. Net First Platinum:

Unlock $750 Credit Line Today!

- No Employment or Credit Check

- Bad Credit, No Credit – OK!

- Easy Online Application

5. Chime Secured Credit Builder Visa®:

A New Way to Build Credit!

- No Annual Fee or Interest

- No Credit Check

- No Minimum Security Deposit Required

Having access to a card and not having to pay cash or rely on debit can be a game-changer. If you have poor credit or little to no credit history, the options may seem limited, but the five cards we’ve listed – Merit Platinum, the Current Build Card, Accepted Platinum, Net First Platinum, and Chime’s Secured Credit Builder Visa – provide a glimmer of hope. They offer the opportunity to build your credit, manage your expenses, and gain control over your financial life.

Discover related topics

No matter where you are on your financial journey, these no credit check cards can be an essential tool for making progress. They offer a chance to improve your financial standing, establish a positive credit history, and pave the way for a more secure financial future. So, take that first step toward financial empowerment and explore these card options to get your financial life back on track.